The VC Funding Party Is Over

The VC Funding Party Is Over

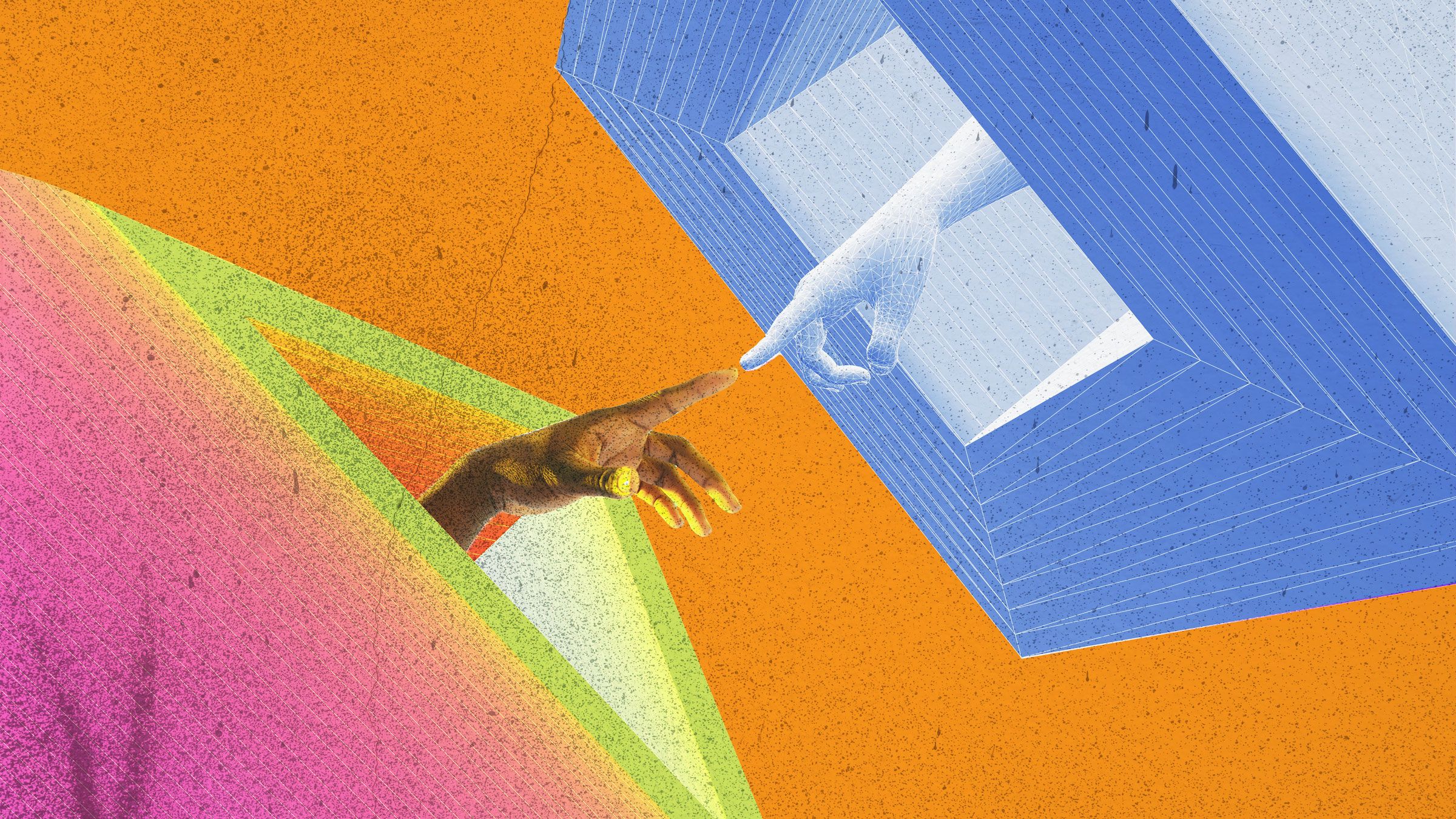

For years, startups have enjoyed a funding frenzy with venture capitalists pouring billions of dollars into promising companies. However, recent trends suggest that the party may be coming to an end.

Investors are becoming more cautious, focusing on profitability and sustainable growth rather than just rapid expansion at all costs. This shift in mindset has led to a slowdown in funding for many startups, especially those in industries that have been struggling to turn a profit.

Furthermore, the economic uncertainty brought on by the COVID-19 pandemic has only exacerbated the situation. Many VCs are now hesitant to make big investments, opting instead to wait and see how the market evolves.

As a result, startups are finding it increasingly difficult to secure the funding they need to survive and grow. Many are being forced to cut costs, lay off employees, or even shut down entirely.

While this may signal the end of the VC funding party as we know it, it also presents an opportunity for startups to focus on building sustainable businesses that can weather economic downturns and attract investors based on their fundamentals rather than just hype.

Ultimately, the VC funding landscape is evolving, and startups will need to adapt in order to succeed in this new era of cautious investing.

So, while the party may be over for now, there is still hope for those companies that are able to pivot, innovate, and demonstrate their value to investors in a changing market.